A New Year is underway for capital markets, and the consensus prognostications are tilted toward a favorable year for both stocks and bonds. Such a rosy outlook is not without risks, of course. As a result, it is worthwhile to consider where we are starting the year with some key indicators that will be important to monitor for stock market success as we progress through 2024.

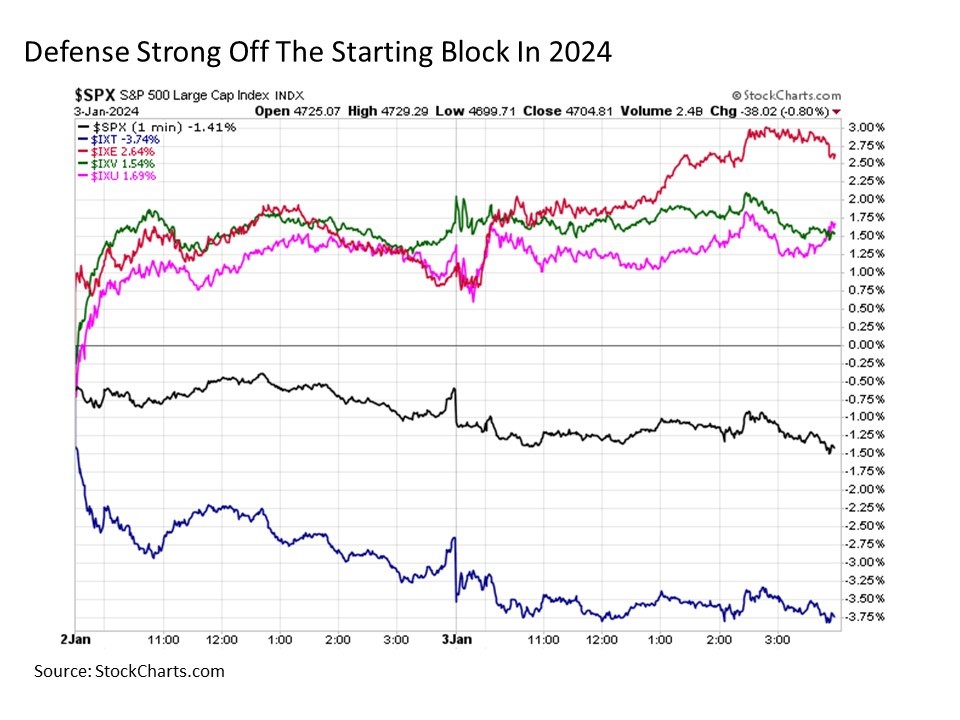

Notable start. The trading year is only two days old with roughly 250 more trading days still ahead in 2024. Thus, one should not draw any conclusions about what we have seen so far from such a limited sample. Nonetheless, some initial developments are of note. Leading the headlines is the long soaring technology sector stumbling off of the 2024 starting blocks. This suggests that at least a few investors that were riding the Magnificent Seven train into their 2023 year end statement station are wasting no time detraining with the New Year getting underway.

So what segments have been leading the stock market at the very start of 2024? While energy stocks have received a boost from the +3% rise in oil prices in the first few days of the year, more notable has been the pop in defensive sectors including health care and utilities. Once again, only a couple of days, but worth watching as the first week of the year draws to a close.

Setting the bar. More importantly, considering where key economic and market metrics stand as we enter the New Year is a worthwhile exercise, as it sets the bar against which we will be monitoring and evaluating these key statistics going forward.

Let’s start with U.S. GDP. Market watchers were trembling over the idea of a recession as 2023 got underway, but it has yet to materialize. But with signals like the Leading Economic Indicators at nearly -8% on a year-over-year basis still raising the recession warning flag, it will be important to keep an eye on the economic outlook in the months ahead. Why? Because economic recessions usually mean lower corporate profits that often lead to lower stock prices.

Where do we stand today on the economic outlook front? So far, so good.

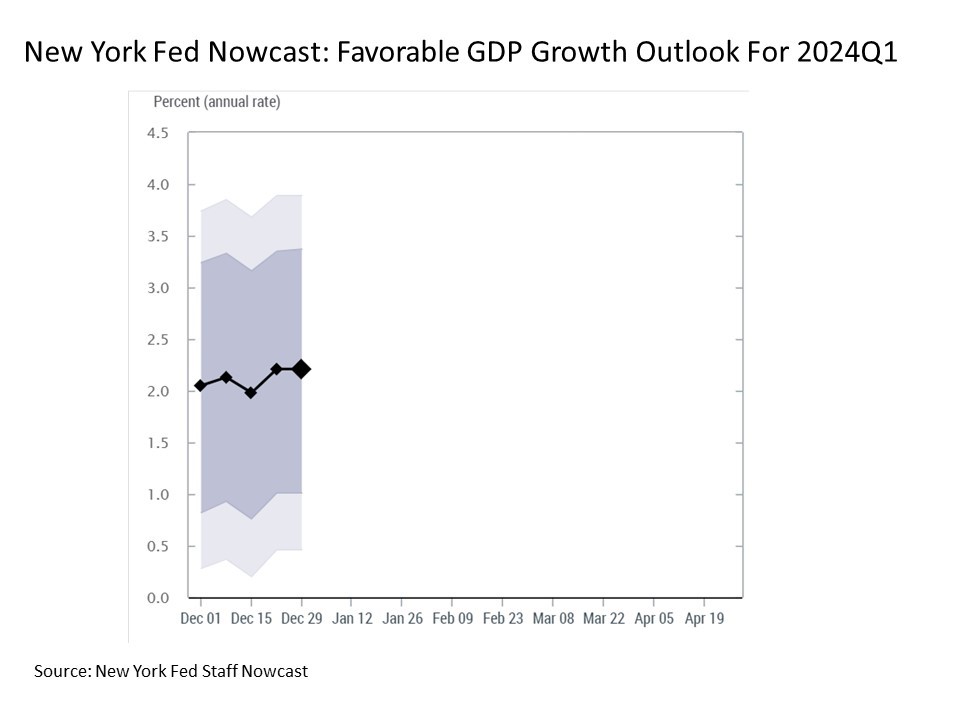

GDP. First, consider that we are still waiting for the preliminary reading on 2023 Q4 GDP at the end of this month, but expectations for the just completed quarter remain in the solid +2% neighborhood according to both the Atlanta Fed GDPNow and the New York Fed Nowcast. Of course, the stock market typically does not price off of what has already been, but instead on what it thinks lies ahead. As a result, it’s arguably more important to consider what lies ahead for economic output.

According to the New York Fed Nowcast, preliminary indications are for another +2% quarter of GDP growth in 2024 Q1. Good news for those that care about underlying fundamentals. Bad news for those hoping for rate cuts from the U.S. Federal Reserve sooner rather than later.

Fed. Speaking of the Fed, what are the latest projections for monetary policy interest rates as we enter 2024? Check it. The CME FedWatch Tool is currently signaling a 73% chance of a quarter point rate cut at the Fed’s March meeting, a 62% chance of a second cut in May, another 62% chance of a third cut in June, 55% odds for a fourth cut in July, 51% odds (still better than a coin flip) for a fifth cut in September, and then a 35% chance for a sixth quarter point cut in November and 29% odds for a seventh in December. Let’s reiterate for emphasis – the market is currently pricing in better than 50% odds that the Fed will cut interest rates by 1.25 percentage points by September leading up to the next Presidential election that is likely to be a tad more contentious this time around. And this is in an environment where +2% GDP growth is still being projected in the first quarter of the year. Um, ok. Needless to say, I’m taking the hard over on these Fed funds forecasts (I’m not sure we’re going to get even one rate cut in 2024 much less five), but as long as the market is in anticipation mode, the markets are likely to benefit even if we don’t get the cuts as expected.

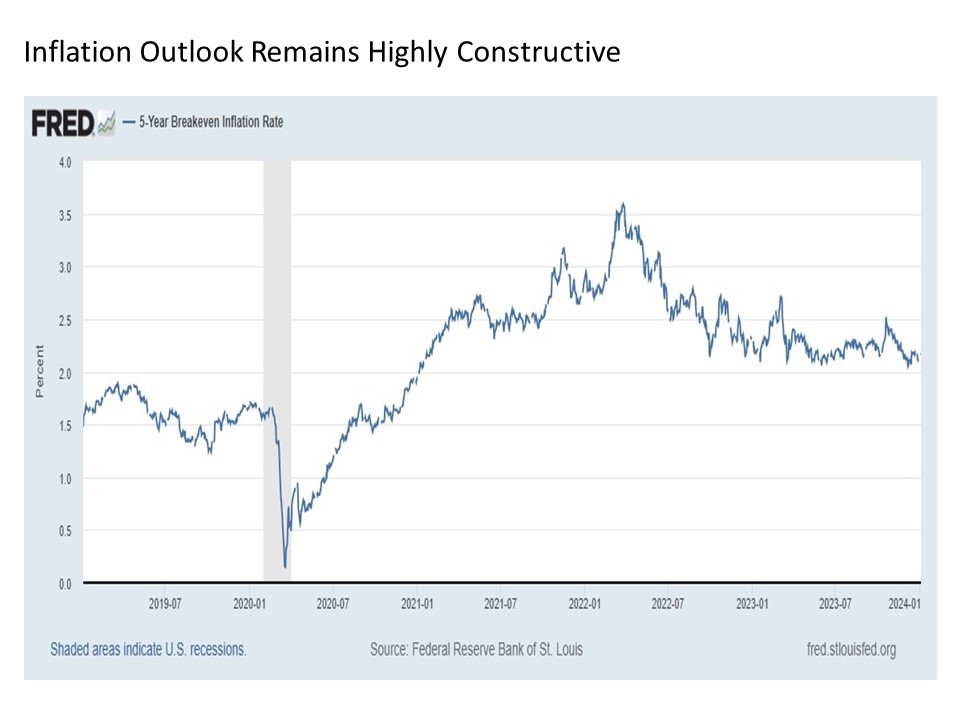

Inflation. One critically important factor that would allow the Fed the flexibility to cut interest rates is the inflation outlook. Heading into 2024, the threat of a renewed rise in inflation remains my number one downside risk to watch for capital markets. But the good news is that pricing pressures continue to come down.

Consider the latest projections from the Cleveland Fed Inflation Nowcasting. While much attention is placed on the Consumer Price Indices, it’s arguably even more worthwhile to track the Personal Consumption Expenditures (PCE) data. And according to the Cleveland Fed forecasters, the headline PCE annual rate is set to drop to 2.3% and the Core PCE to below 2.8% by the January reading. This is good stuff for both stock and bond prices as the year gets underway.

Moreover, with the 5-Year breakeven inflation rate hovering just above 2% near its lowest levels since the inflation outbreak, investors have reason for constructive optimism in the year ahead on the inflation and Fed policy flexibility front.

Unemployment. One more economic indicator before we move on. The unemployment rate remains at just 3.7%, still at the lowest levels since the late 1960s. While employment is a coincident indicator from a market perspective, if we see this reading pushing steadily and solidly north of 4%, this would signal that an economic slowdown is taking hold. Whether markets choose to simply look past any such economic weakness along the way remains to be seen.

Enough about the economy. Let’s move on to key market fundamentals.

Corporate profits. Let’s start with the bottom line for the companies that make up our stock markets. S&P Global is currently projecting solid corporate as reported earnings growth in the year ahead. This includes an over 5% sequential quarter-over-quarter increase in the just completed 2023 Q4 along with 1.4% in 2024 Q1, 2.5% in Q2, 5.2 in Q3, and 4.4% in Q4. These are solid earnings growth numbers. Now this Chief Market Strategist expects that these profit growth readings are likely to come in a bit lower than currently forecast, but will likely remain positive nonetheless.

Valuations. Companies delivering on profit growth will be important in the year ahead. This is due to the fact that the S&P 500 is now trading at a frothy 26 times trailing 12-month as reported earnings. And with T-bills still kicking of 5.5% yield and the 10-Year U.S. Treasury yield trading at 3.9%, there are reasonable alternatives to a stock market currently offering only a 3.8% earnings yield (read: negative equity risk premium) to “compensate” investors for the added liquidity, default, and equity related uncertainty at current valuations.

The good news is that despite this seemingly rich headline valuation on the S&P 500, when one removes the mega big Magnificent Seven stocks from the mix, valuations suddenly become a lot more reasonable for longer-term investors. Same holds true when considering mid-caps and small caps, both of which remain near historically discounted valuations dating back over three decades.

Bottom line. These are just a few of the key indicators to watch and monitor as we progress through the year ahead. And the good news is that many of these indicators continue to point in the right direction as the New Year gets underway.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #:523742-1