Changes to the political landscape continue to unfold in the wake of the Republican sweep in the 2024 elections. The financial market reaction has also been dramatic, as U.S. stocks have rallied strongly in the days since Election Day with the removal of the uncertainty of who will be running the executive branch as well as the U.S. Senate and …

Economic & Market Report: 2024 Election Results – Market Impact

The election results are in. In a stunning outcome, Donald Trump and the GOP emerged from voting on Tuesday with a resounding victory.

Economic & Market Report: The Heat Is On

It was all going so well for the doves. The U.S. stock market continued to surge to new all-time highs at the same time that bond yields were plunging, all in anticipation of the U.S. Federal Reserve cutting interest rates at their mid-September Open Market Committee meeting.

Economic & Market Report: Stocks Don’t Care Who Wins

We’ve got a big election coming up in the United States that’s now less than two weeks away.

Economic & Market Report: Silver and Gold

The U.S. stock market continues to claim new all-time highs. But another segment of capital markets is also glistening brightly as we continue through 2024.

Economic & Market Report: Rekindling the Flames

It continues to top the charts as a major downside risk for capital markets as we continue through the 2020s. It sent the markets reeling a few years ago, and the problem was never fully eradicated even though the focus of policy makers has since turned elsewhere.

Economic & Market Report: Theory of Market Relativity

Investing is a long-term game. And when evaluating long-term portfolio opportunities, it is worthwhile to consider the relative performance of various segments relative to the broader market.

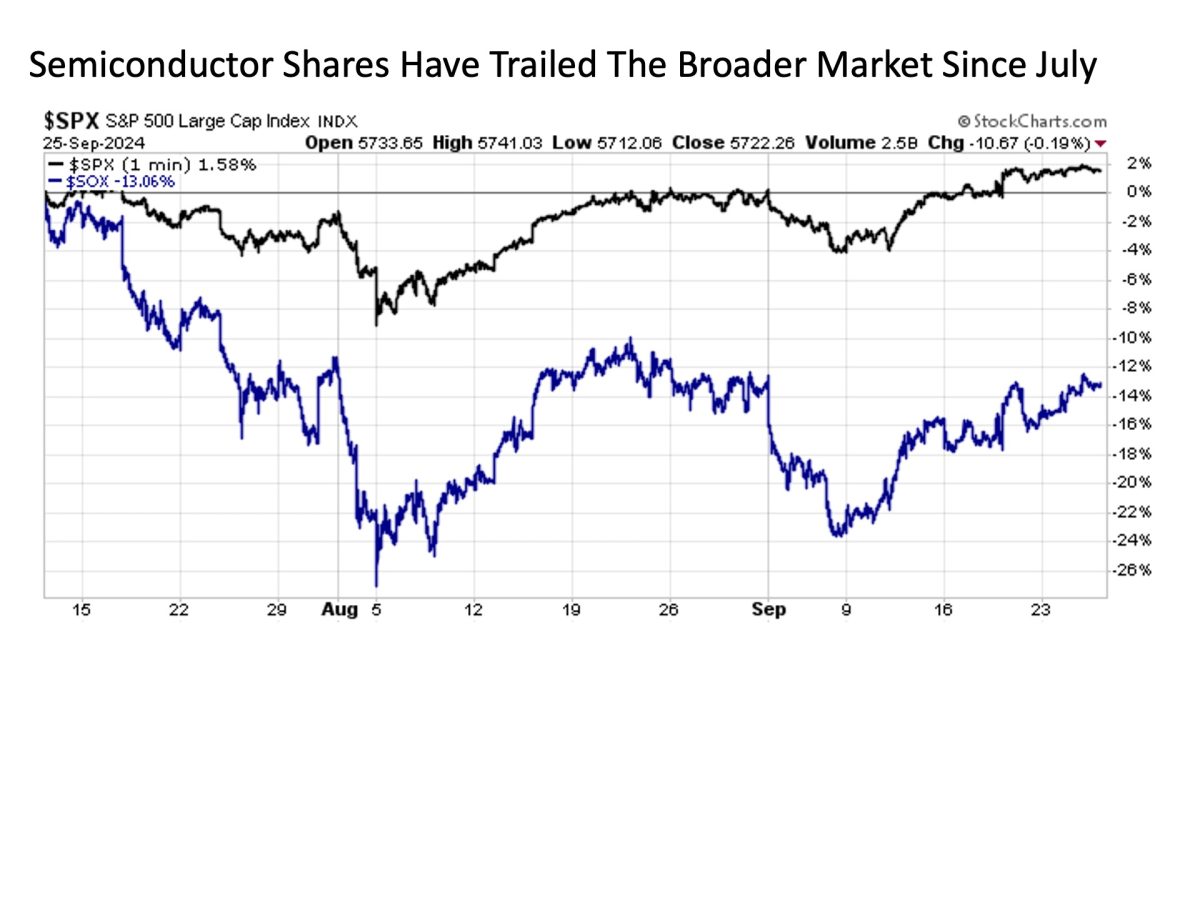

Economic & Market Report: Knock Your Sox Off

A changing of the guard appears to be taking place in the U.S. stock market. The S&P 500 Index continues to set fresh all-time highs with a year end run toward 6000 increasingly coming into view.

Economic & Market Report: Why The Fifty?

The U.S. Federal Reserve still managed to deliver a surprise to markets this week.

Economic & Market Report: Careful What You Wish For

The time has finally come. At long last and following nearly two years of anticipation, the U.S. Federal Reserve is ready to begin delivering the interest rate cuts investors have longed for.